Algorithmic trading has reshaped global finance, allowing trades to be executed in microseconds using AI-driven models and data analytics. In these systems, decisions are based on vast streams of real-time market data, and execution speed determines success. The shorter the latency, the greater the competitive advantage.

In this race for speed and intelligence, traditional CPU and GPU-based platforms often fall short. While powerful, they are limited by sequential processing and software-level overhead. The answer lies in hardware acceleration, and among modern computing platforms, the AMD Versal™ Adaptive SoC (Gen 2) stands out as the most complete and efficient solution.

Why Latency Is Everything

Latency is the time delay between market data arriving and a trading action being executed. Even a few microseconds can make or break profitability in today’s markets.

For instance, an algorithm that processes data and makes a buy/sell decision a few microseconds faster can consistently capture better prices, arbitrage opportunities, and liquidity. To achieve this level of responsiveness, the hardware must process, analyze, and act in parallel, with minimal communication delay between components.

This is precisely where the Versal Gen 2’s heterogeneous architecture shines.

AMD Versal™ Gen 2: Built for Ultra-Low-Latency Intelligence

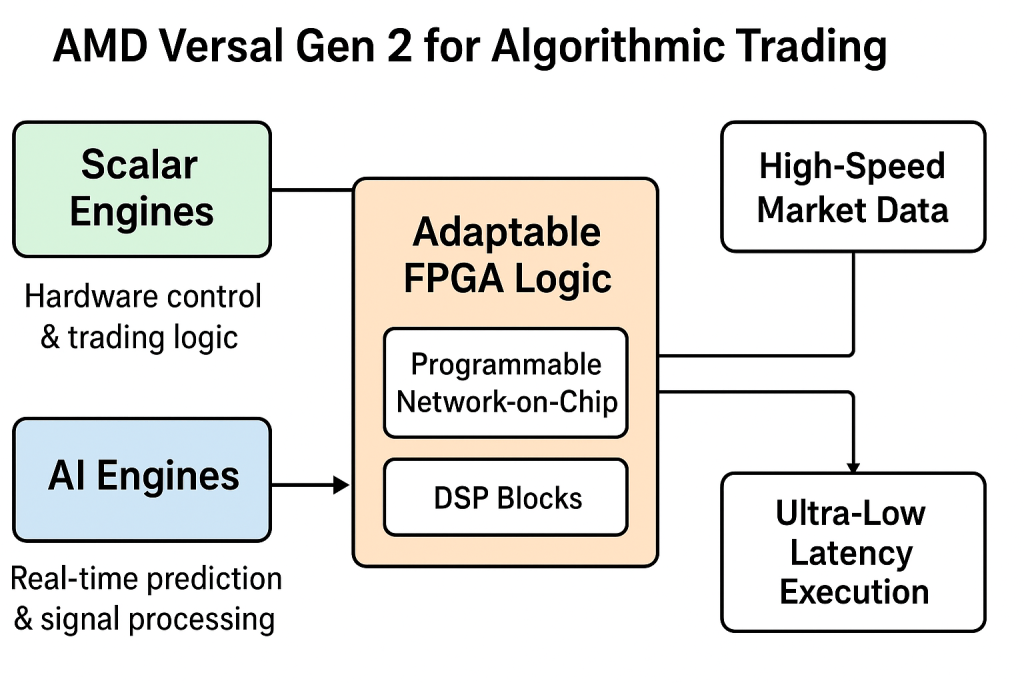

The AMD Versal Gen 2 platform combines multiple computing domains into one unified chip:

- Scalar Engines for control and decision logic

- AI Engines (AIEs) for machine learning inference and parallel numerical computation

- Adaptable FPGA Logic (Programmable Network-on-Chip and DSP blocks) for ultra-fast, deterministic data processing

Each of these subsystems plays a unique role in accelerating the end-to-end algorithmic trading pipeline, from market data ingestion to trade execution.

Scalar Engines: Real-Time Control and Decision Logic

The Scalar Engines in Versal Gen 2 are general-purpose processors optimized for low-latency control. They manage the flow of data through the system, make fast logical decisions, and coordinate hardware tasks.

In algorithmic trading, these scalar cores can:

- Implement the main trading logic: monitoring signals and controlling execution pipelines.

- Handle protocol management for high-speed data feeds such as FIX, ITCH, or OUCH.

- Execute risk management and compliance checks in line, without interrupting the main data flow.

Because these cores are tightly coupled to the rest of the chip’s processing domains, they can respond to incoming market data in microseconds, not milliseconds, ensuring trade decisions happen with minimal software overhead.

AI Engines: Real-Time Market Prediction and Signal Processing

The AI Engines (AIEs) are the heart of the Versal Gen 2’s intelligence. These are massively parallel vector processors designed for high-speed, low-power machine learning inference and numerical computation.

In algorithmic trading, AI Engines enable:

- On-chip prediction models that analyze market depth, order book dynamics, and price patterns in real time.

- Signal filtering and feature extraction, turning raw data into actionable indicators with virtually no delay.

- Adaptive model execution, where trading strategies use reinforcement or statistical learning to react instantly to changing market conditions.

Because inference happens directly on the chip, there’s no need to send data to external GPUs or servers, eliminating communication latency and ensuring deterministic, ultra-fast performance.

Adaptable FPGA Logic: Parallel Execution and Deterministic Timing

The FPGA fabric within Versal Gen 2 is what makes it truly unique. It allows developers to design custom hardware pipelines that execute trading tasks at hardware speeds.

This reconfigurable logic can be tailored for:

- Ultra-fast data parsing and normalization of incoming market feeds.

- Tick-by-tick data aggregation and order book construction in nanoseconds.

- Custom mathematical models, optimized directly in logic for predictable, deterministic execution.

- Low-latency network interfaces, with the ability to bypass traditional software stacks and connect directly to network transceivers.

Unlike CPUs or GPUs, which process instructions sequentially, FPGA logic executes tasks truly in parallel and with consistent, repeatable latency, a must-have feature in trading environments where jitter can cost money.

Integrated NoC (Network-on-Chip): Lightning-Fast Data Movement

One of the bottlenecks in traditional systems is data transfer between compute units. The Versal Gen 2 addresses this with its programmable Network-on-Chip (NoC), a high-speed interconnect fabric that links scalar engines, AI engines, and FPGA logic.

For algorithmic trading, the NoC ensures that:

- Market data streams are delivered to processing units with predictable, ultra-low latency.

- Partial computation results (such as intermediate AI predictions or filtered data) can be passed seamlessly between units.

- System communication happens on-chip, without waiting for external memory access.

This internal network provides the high bandwidth and determinism needed to process massive market data streams in real time.

Power Efficiency and Compact Deployment

Despite its extreme performance, the Versal Gen 2 is remarkably energy efficient. This means entire algorithmic trading systems, including AI inference, logic processing, and control, can operate within modest power envelopes.

As a result, multiple systems can be deployed in a compact server rack, small enough to fit in a standard office or trading room. These racks can run comfortably from ordinary electrical power outlets, without requiring specialized data center cooling or high-voltage infrastructure.

This makes high-speed trading technology accessible to small firms, startups, and even individual traders, dramatically lowering the barrier to entry for professional-grade algorithmic trading.

SundanceDSP: Experts in Versal Gen 2 System Design

SundanceDSP specializes in developing high-performance systems built around AMD’s Versal Gen 2 technology. With deep expertise in FPGA design, AI integration, and low-latency data systems, SundanceDSP can design, prototype, and deliver complete trading solutions in record time.

From custom hardware accelerators to fully integrated trading platforms, SundanceDSP provides the tools and know-how to harness the full power of Versal Gen 2. Whether your goal is to execute trades in microseconds, process massive data feeds, or build AI-enhanced predictive models directly on hardware, SundanceDSP can deliver a tailored solution optimized for your trading strategy.